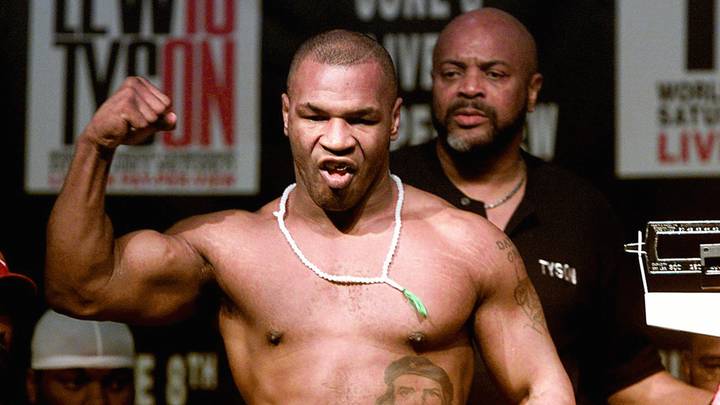

Mike Tyson famously said “Everybody has a plan until they get punched in the mouth.” From there, you’ll have to see how your plan survives it’s collision with reality. And so it goes for you and I as well. Hopefully, you’re not physically getting punched in the mouth, but we’ve all figuratively been thanks to COVID.

If you’re a trained boxer, you’re used to getting punched. But even the most prepared fighters had a hard time dealing with a punch from Tyson. If you were financially prepared, COVID has still hurt, but you were ready. You’ve been able to weather it.

What if you weren’t prepared? Did you get knocked out?

In 2017, Americans paid over $5.7 Billion in early withdrawal penalties for prematurely taking money out of IRAs and 401(k)s (Normally, a 10% penalty is assessed for taking money out of your retirement account prior to 59 and a half). When the dust settles on this tax year, we’ll see how much money has come out of these plans prematurely. Now, the good news is the penalties have been waived due to COVID, but that’s not the end of the story.

The second punch.

Taxes. I wonder how many people who have taken these withdrawals realize they’ll owe ordinary income tax on that money. Now, if you needed the money to survive, I get it. Either way, it’s a second punch coming that many won’t be prepared for.

The knockout blow?

Time and opportunity costs. We all recognize the earlier we start saving the better; time is the thing we all have the same amount of. If you’re in your 40’s or 50’s, with little to no money saved, you’ve got an uphill climb ahead of you.

Hopefully this isn’t you. Hopefully you’re diligently putting money away.

If it is you, that’s okay too. What’s not okay is doing nothing about it. The first step towards financial prosperity is financial security. We do that by cutting expenses and lifestyle costs and setting up an emergency fund.

Whatever else you’re doing, stop. First step, $1,000 saved. Next, one month’s expenses. Continue this process till you’ve got three months saved, then four, then five, then six. When you’ve done that, you’ve got financial security and you’ll be able to withstand future punches.

Get started.