Become an Investor with Dr. Preston Cherry

Technology has made investing available to anyone with a smartphone and along with it, the opportunities for good and bad outcomes. Dr. Preston Cherry shares his perspective on what it means as well as the important variables to keep in mind on your path to becoming a successful investor!

Listen to us On

About the Episode

LifeBlood: We talked about how to become an investor, Preston’s career path, his passion for the financial industry, how he was taught money concepts by his parents, how he’s done many roles in the financial industry and how that prepared him for his current role.

We talked about his experience starting a Financial Planning program at a University, the interest level of students in the field, and how young people are feeling about the financial world in general.

We discussed the impact of financial technology companies on the world of investing, and how that plays into someone’s overall financial plan. We talked about the importance of trust, the need for investors to have a good understanding of risk and return, and how tech is having the effect of commoditizing some aspects of the financial planning process.

We talked about how it’s possible to find success and consistency as a trader, but it takes time, effort and attention with Dr. Preston Cherry, CFP, a Your Life Money Balance Financial Planner, the Founder and President of Concurrent Financial Planning, a Speaker, Professor, Researcher and cool uncle.

Listen to learn how to become grittier and the role it can play in our overall success!

For the Difference Making Tip, scan ahead to 21:11!

You can learn more about Preston at ConcurrentFP.com, Facebook, Twitter and LinkedIn.

Thanks, as always for listening! If you got some value and enjoyed the show, please leave us a review wherever you listen and subscribe as well.

You can learn more about us at MoneyAlignmentAcademy.com, Twitter, LinkedIn, Instagram, Pinterest, YouTube and Facebook or you’d like to be a guest on the show, contact George at Contact@GeorgeGrombacher.com.

George Grombacher

Lifeblood Host

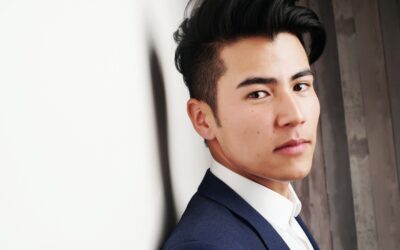

Dr. Preston Cherry

Guest

More Episodes

Goal Setting: How to Effectively Think About and Set Goals

We, as humans, have many amazing superpowers. One of my clear favorites is our ability to create the future we desire. It’s truly amazing if you think about it. When you take the time to reflect on what you want your future to look like, when you create a plan of...

Buying Your Next Home: A Step-by-Step Process

You’re thinking about buying a home, that’s very exciting! Home ownership has always been an integral part of the American Dream, and home values account for a large portion of many Americans overall net worth. With that in mind, it makes sense you want to...

Personal Core Values: How to Create Your Code

Superman, Wonder Woman, Mother Teresa and Gandhi lived their personal values and followed a code. Superman holds strong to not killing, keeping his secret identity a secret, and using his powers responsibly. Wonder Woman lives to serve as a living example of the...

What Does It Mean to Wholesale Real Estate, How Do I Do It and Does It Make Sense for Me?

There are a lot of ways to become financially successful and there are a lot of people who have done so through the wholesale of real estate. Before we go any further, if you’re looking for a way to channel your inner Chip and Joanna Gaines from Fixer Upper,...

Understanding Presenteeism in the Workplace and What to Do About it

We celebrate when our sports heroes play hurt and we dislike it when they sit out. In the 2021 Summer Olympics, American gymnast Simone Biles opted out of competing because of her mental health and she was viciously criticized. We revere stories about...

How to Start a 401(k)

Daniel Kahneman, a Psychologist, won the Nobel Prize in Economics. He became fascinated by why people make personal finance and investing decisions, and it motivated him to focus his research on it. After releasing his results, he made this damning assessment of the...

Debt Free: What to Do if You’re Over Budget and Feeling Stuck

You want to be debt free. You created a budget. You’re trying to be smart with your money. But there’s never enough money to go around and you’re feeling stuck. Lots of people have been there and lots are still there. I’ve been...

Financial Wellness: Developing a Sustainable Program

It’s gotta fit. Even if the new thing you’re starting is the most beneficial thing in the world, if it doesn’t fit into your life or organization, it won’t last. It won’t be sustainable. A financial wellness program could be just what your company and your...

Steps to Success: What it Means to Level Up

What if there were steps to success you could follow that would take you to the level above the one you’re at? What if you could then lock in your gains and make that level your new normal? Would you take those steps? There’s a lot of talk these days...

Join the show.

Interested in being on the show? Tell me a little bit more about you and what you’d like to talk about!