Get Better at Sales with Ambrose Blowfield

When thinking about sales, do you have a scarcity or abundance mindset? Ambrose Blowfield talks about the reasons behind why we feel that way and how best to overcome it in order to better serve our customers!

Listen to us On

About the Episode

LifeBlood: We talked about Ambrose’s experiences growing up all over the world, what it’s like to have an English accent while living in Australia, the knowledge gained over a 20 year career in sales, and the value of confidence.

The two primary reasons sales people fail to reach their potential and how to address and overcome them. Why focusing on the customer and the value you’re delivering is the starting point to a successful sales interview, how to seek understanding first, then offer solutions, and why it’s selfish to do anything other than that.

Why the Wolf of Wall Street is a lousy role model and how to do business the correct way, the importance of having an organized sales process and the value of a good question with Ambrose Blowfield, one of Australia’s top sales trainers and speakers, and author of the book Shut Up to Sell.

Listen to learn why it’s possible to teach an old dog new tricks and why we need to be lifelong learners!

For the Difference Making Tip, scan ahead to 18:12!

You can learn more about Ambrose at SalesMasteryCompany.com, Facebook, Twitter, YouTube and LinkedIn.

Thanks, as always for listening! If you got some value and enjoyed the show, please leave us a review wherever you listen and subscribe as well.

You can learn more about us at MoneyAlignmentAcademy.com, Twitter, LinkedIn, Instagram, Pinterest, YouTube and Facebook or you’d like to be a guest on the show, contact George at Contact@GeorgeGrombacher.com.

George Grombacher

Lifeblood Host

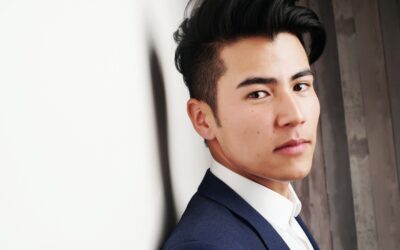

Ambrose Blowfield

Guest

More Episodes

Goal Setting: How to Effectively Think About and Set Goals

We, as humans, have many amazing superpowers. One of my clear favorites is our ability to create the future we desire. It’s truly amazing if you think about it. When you take the time to reflect on what you want your future to look like, when you create a plan of...

Buying Your Next Home: A Step-by-Step Process

You’re thinking about buying a home, that’s very exciting! Home ownership has always been an integral part of the American Dream, and home values account for a large portion of many Americans overall net worth. With that in mind, it makes sense you want to...

Personal Core Values: How to Create Your Code

Superman, Wonder Woman, Mother Teresa and Gandhi lived their personal values and followed a code. Superman holds strong to not killing, keeping his secret identity a secret, and using his powers responsibly. Wonder Woman lives to serve as a living example of the...

What Does It Mean to Wholesale Real Estate, How Do I Do It and Does It Make Sense for Me?

There are a lot of ways to become financially successful and there are a lot of people who have done so through the wholesale of real estate. Before we go any further, if you’re looking for a way to channel your inner Chip and Joanna Gaines from Fixer Upper,...

Understanding Presenteeism in the Workplace and What to Do About it

We celebrate when our sports heroes play hurt and we dislike it when they sit out. In the 2021 Summer Olympics, American gymnast Simone Biles opted out of competing because of her mental health and she was viciously criticized. We revere stories about...

How to Start a 401(k)

Daniel Kahneman, a Psychologist, won the Nobel Prize in Economics. He became fascinated by why people make personal finance and investing decisions, and it motivated him to focus his research on it. After releasing his results, he made this damning assessment of the...

Debt Free: What to Do if You’re Over Budget and Feeling Stuck

You want to be debt free. You created a budget. You’re trying to be smart with your money. But there’s never enough money to go around and you’re feeling stuck. Lots of people have been there and lots are still there. I’ve been...

Financial Wellness: Developing a Sustainable Program

It’s gotta fit. Even if the new thing you’re starting is the most beneficial thing in the world, if it doesn’t fit into your life or organization, it won’t last. It won’t be sustainable. A financial wellness program could be just what your company and your...

Steps to Success: What it Means to Level Up

What if there were steps to success you could follow that would take you to the level above the one you’re at? What if you could then lock in your gains and make that level your new normal? Would you take those steps? There’s a lot of talk these days...

Join the show.

Interested in being on the show? Tell me a little bit more about you and what you’d like to talk about!