Get Better at Sales with Ambrose Blowfield

When thinking about sales, do you have a scarcity or abundance mindset? Ambrose Blowfield talks about the reasons behind why we feel that way and how best to overcome it in order to better serve our customers!

Listen to us On

About the Episode

LifeBlood: We talked about Ambrose’s experiences growing up all over the world, what it’s like to have an English accent while living in Australia, the knowledge gained over a 20 year career in sales, and the value of confidence.

The two primary reasons sales people fail to reach their potential and how to address and overcome them. Why focusing on the customer and the value you’re delivering is the starting point to a successful sales interview, how to seek understanding first, then offer solutions, and why it’s selfish to do anything other than that.

Why the Wolf of Wall Street is a lousy role model and how to do business the correct way, the importance of having an organized sales process and the value of a good question with Ambrose Blowfield, one of Australia’s top sales trainers and speakers, and author of the book Shut Up to Sell.

Listen to learn why it’s possible to teach an old dog new tricks and why we need to be lifelong learners!

For the Difference Making Tip, scan ahead to 18:12!

You can learn more about Ambrose at SalesMasteryCompany.com, Facebook, Twitter, YouTube and LinkedIn.

Thanks, as always for listening! If you got some value and enjoyed the show, please leave us a review wherever you listen and subscribe as well.

You can learn more about us at MoneyAlignmentAcademy.com, Twitter, LinkedIn, Instagram, Pinterest, YouTube and Facebook or you’d like to be a guest on the show, contact George at Contact@GeorgeGrombacher.com.

George Grombacher

Lifeblood Host

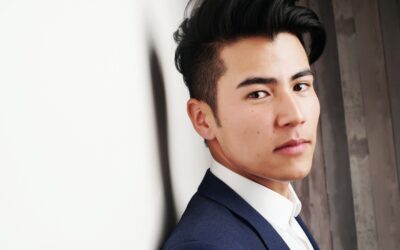

Ambrose Blowfield

Guest

More Episodes

How to Get Out of Debt and Become Financially Secure in 7 Steps

I’m going to show you how to get out of debt and become financially secure in these 7 steps Know your “facts.” When talking about personal finance, your facts are your current financial situation, meaning your cash flow and budget. Know yourself. It’s imperative...

Do I Need Life Insurance, What are the Benefits and How Do I Get It?

Do I need life insurance? Like the answer to many good financial questions, the answer is, it depends. But you probably need it. Do you love someone (or something)? Do you owe someone (or something)? Do you have a family,...

Stop Living Paycheck to Paycheck: How to Master Your Cash Flow

The fact that almost 65% of Americans are living paycheck to paycheck violates one of my first principles of personal finance; spend less than you make. It’s also a perfect example of the behavior gap. Meaning, having an intellectual understanding of something,...

The Teachings of Jesus: Taking Personal Responsibility for Your Life

One of my favorite teachings of Jesus is the parable of the talents. In it, Jesus shares a story meant to illustrate the importance of putting all of your God-given gifts to work, and to take risks. Failure to do so results in negative judgment. This...

Want a Life of Significance? Here’s the Work Ethic You’ll Need and How to Get It

Having a life of significance is available to you. This will walk you through the steps to make it happen. That you’re reading this suggests you desire a life of significance, and I commend you for it. It’s my desire to help you live one. I think everyone is...

Understanding Investment Risk: Your Risk Profile

There are fewer things in personal finance more important than taking on the proper amount of risk, and fewer tools more ineffective at determining the proper amount of risk than a traditional risk tolerance profile. If you’re not familiar with what I’m talking...

What is Financial Planning and Can I Do It Myself?

Financial planning is the process of determining your financial goals, looking at your current situation, and devising strategies for achieving those goals. It’s best viewed as a process because it will need to be updated as your life changes. The tangible...

Overcoming Adversity: How to Respond When Things Go Wrong

Bad things happen to us. Me dropping my ice cream when I was four was bad. My parents getting divorced when I was five was worse. Adversity, also known as difficulty or misfortune, comes at us in different levels. The trick is what we do when it happens;...

How to Make Friends as an Adult

I’ve got friends I grew up with, friends I went to college with, and I met some of my best friends as an adult. But it can be a struggle for grown-ups to make new friends. It’s harder to develop deep relationships when we’re grown up. We’ve got a lot more...

Join the show.

Interested in being on the show? Tell me a little bit more about you and what you’d like to talk about!