EPISODE #1034

Having a Plan with Paul Axberg

We talked about the value of having an integrated financial plan, how having one provides confidence and greater certainty, and how to get started!

Listen to us On

About the Episode

LifeBlood: We talked about the value of having an integrated financial plan, how having one provides confidence and greater certainty, and how to get started with Paul Axberg, CPA, CFP, CIMA and President of Axberg Wealth Management. Listen to learn how to proactively handle healthcare costs in retirement!

For the Difference Making Tip, scan ahead to 16:44!

You can learn more about Paul at AxbergWealth.com, Facebook and LinkedIn.

George Grombacher

Lifeblood Host

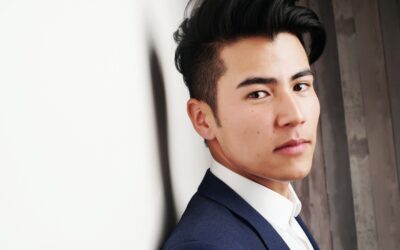

Paul Axberg

Guest

More Episodes

What is Success? Thoughts on How to Feel Like You’re Succeeding

Are you succeeding? What is success and how to become successful are big, important questions that, up until recently, I didn’t spend much time thinking about. Don’t get me wrong, working hard and wanting success have constantly been on my mind my entire life. I just...

What Should My Credit Score be Before Buying a Home and What Else Do I Need to Know?

Before buying a home, it’s recommended you have a credit score above 620 to qualify for a conventional loan. There are a lot of loan programs available to help you realize the dream of home ownership. I’m going to share with you the steps to take to get the most...

Our Favorite Personal Responsibility Quotes and How You Can Apply Them In Your Life

So much of life is out of our control. We have no control over when or where we were born, who our parents are, our genetics, other people, or what happens to us. We do have control over what we do with our lives, how we respond to situations, and our...

Should I Take Out a Personal Loan? The Answer and an Overview of What They Are

Should I take out a personal loan? Is a personal loan right for me? Are personal loans good or bad? I’m going to answer all of those questions and give you the information you need to make an educated decision. I’ve spent over 20 years as a financial advisor and...

Invest in Yourself: A Four-Step Process for Change

You and I have one shot at this. One trip around the track. Will you invest in yourself, or will you simply take what life gives you? When we hit 40 or so, this reality begins to sink in. Sure, it’d be better if we came to this realization earlier, but better late...

How Do I Improve My Credit?

Improving and maintaining your credit is an important step on your path to financial success. Credit is an integral part of our lives that can impact where we live, the kind of car we drive, and even where we work. Having good credit can bring down the costs...

Goal Setting: How to Effectively Think About and Set Goals

We, as humans, have many amazing superpowers. One of my clear favorites is our ability to create the future we desire. It’s truly amazing if you think about it. When you take the time to reflect on what you want your future to look like, when you create a plan of...

Buying Your Next Home: A Step-by-Step Process

You’re thinking about buying a home, that’s very exciting! Home ownership has always been an integral part of the American Dream, and home values account for a large portion of many Americans overall net worth. With that in mind, it makes sense you want to...

Personal Core Values: How to Create Your Code

Superman, Wonder Woman, Mother Teresa and Gandhi lived their personal values and followed a code. Superman holds strong to not killing, keeping his secret identity a secret, and using his powers responsibly. Wonder Woman lives to serve as a living example of the...

Join the show.

Interested in being on the show? Tell me a little bit more about you and what you’d like to talk about!