I Owe: Sacrifices and Investments

Each of us owe a debt that we’ll never be able to repay. And repayment is not a sacrifice, it’s an investment that builds upon the sacrifices of the brave men and women who have served our Country.

Listen to us On

About the Episode

Each of us owes a debt that we’ll never be able to repay.

And our repayment is not a sacrifice. Rather, it’s an investment. It’s building upon the sacrifices of those who have served our country.

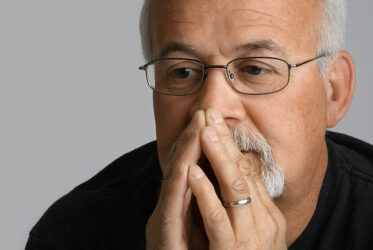

George G talks about how best to honor the memories of those who bravely served in the United States Armed Forces!

Did you get anything out of this episode? Do us a solid and leave a review:

https://ratethispodcast.com/alignedmoneyshow

Learn more and engage at MoneyAlignmentAcademy.com, Twitter, LinkedIn, Instagram, YouTube and Facebook.

Buy George G a coffee (he loves coffee)

https://www.buymeacoffee.com/lifeblood

Have George G speak

https://moneyalignmentacademy.com/speaking/

Financial literacy and wellness for individuals, families, and companies

https://moneyalignmentacademy.com/

Find George G’s books here

The Aligned Money Show is the podcast for Money Alignment Academy, copyright 2024.

George Grombacher

Host

Episode Transcript

I owe, I owe a debt that I’ll never be able to repay. One that I’ll be working to repay every day for the rest of my life. And I assert, I submit that you do as well. We all owe, we are all standing on the shoulders of giants. And today, Memorial Day, those giants are the people who served, who had the courage to put themselves in line, to put the uniform on, and to fight for our country and our way of life. Everything about us. And they did that they do that. So that we can have the lives that we have, so that we can enjoy the lifestyles that we have, that we enjoy, so that we can exercise our freedoms, so that we can protest so that we can be outspoken on whatever it is that we want to be outspoken on. We have the right to do that. We have the ability to do that, that you can get up every day and spend your time however you see fit and pursuit of whatever you have deemed to be worthwhile to follow the impulse to become whoever it is that you want to become. I owe you oh the number of Americans injured in combat throughout history is extensive. World War Two over 670,000 United States service members were wounded. During the Vietnam War, over 153,000 Americans injured the Korean war over 100,000 military personnel were wounded. During the Iraq War, over 32,000 service members were wounded. In Afghanistan, more than 20,000 service members were wounded. The number of the number of Americans who fought and died the American Revolution over 4000 Americans died the Civil War. Over 214,000 soldiers died in World War One over 53,000 died in World War Two. Over 291,000 Americans died in the Korean War. Over 33,000 died in the Vietnam war over 47,000 died. Hundreds died during the Gulf War over 6000 died during the War on Terror over the last several years since 2010.

Over 65,000 veterans have committed suicide as of late that comes out to be over 16 A day credible

I owe a debt to my grandfather my brother Zack, who both served our country

and I owe a debt to I wrote John who gave his life in service to our country

I owe my best I owe the realization of my ultimate potential. What I can be I must be. I owe that to those who have come before me. I owe that to those who have given their lives had been permanently injured, so that I can have my way of life. I owe, I owe to those who cannot do what I’ve been blessed to be able to do. And my repayment is not a sacrifice. It’s an investment. It’s building upon their sacrifices. It’s building bridges for my kids, your kids, and our children’s children, so that they may continue working to realize their potential. And I owe that now. Not tomorrow, not someday in the future. Now, that bill is due today. So how do you pay your debt? You do your part, by doing your best. You square yourself away. You make yourself physically strong, mentally strong, emotionally strong, spiritually strong, and financially strong. You do it by leading the way. You do it by being the example that others need. You become evidence to others of what it means to pay what you owe to pay your debt. You do that by making investments every day. I owe you Oh, I encourage you to keep that in mind. As you go and enjoy whatever you’re doing, realize and recognize that we’re all we’ve all benefited so greatly by countless people that have come before us that have made sacrifices, oftentimes the ultimate sacrifice so that you and I can have the lives that we have.

Happy Memorial Day. Thank you for your service.

More Episodes

Decision Management with Michelle Tinsley

EPISODE #1137 Decision Management with Michelle Tinsley We talked about applying the lessons from corporate America to startup life, the importance of keeping lists and staying organized, how to think about and approach fundraising, and how to make it all work!About...

How to Get Out of Debt – The Three Essential Areas to Focus On

Debt is crushing us. It crushed me for a long time. Getting out of debt is one of the most important financial priorities anyone can have and becoming debt-free is one of the greatest gifts we can give ourselves. If you’re in debt, odds are you feel...

Crypto and Gold with Nick Prouten

EPISODE #1136 Crypto and Gold with Nick Prouten We talked about combining crypto currency with gold and silver, creating a payment ecosystem, competing with large financial institutions, and bringing it all together!About the EpisodeIn this episode, we talked about...

A Journey to Health with Brunde Broady

EPISODE #1151 A Journey to Health with Brunde Broady We talked about a 10 year journey to better understand a little known enzyme, what we can take from her journey, and how to start living healthier lives!About the EpisodeLifeBlood BE WELL: We talked about a 10 year...

Life Choices with Mark Shone

EPISODE #1134 Life Choices with Mark Shone We talked about how the pandemic has motivated many people to reconsider major life choices like where we live, why it’s so important to have your own definition of success, and how to as honest with ourselves and our loved...

Your Travel Style with Danielle Desir

EPISODE #1133 Your Travel Style with Danielle Desir We talked about how travel changed during the pandemic, RV’s and AirBnB’s, exploring rural America, and how to think about the best times to get away!About the EpisodeLifeBlood LIFESTYLE: We talked about how travel...

Forecasting Your Finances with Tyson Koska

EPISODE #1132 Forecasting your Finances with Tyson Koska In this episode, we talked about the challenges and opportunities present in forecasting your financial future, why so many programs are non-intuitive and clunky, and how to make more informed financial...

The Subscription Economy with Paul Chambers

EPISODE #1131 The Subscription Economy with Paul Chambers We talked about the history of subscription services, why companies are moving in that direction more and more, the different categories in the space, and how you can learn more about it!About the EpisodeIn...

Retirement for Entrepreneurs with Matt Franklin

EPISODE #1130 Retirement for Entrepreneurs with Matt Franklin We talked about the factors that keep entrepreneurs from saving for retirement, why it’s important to give ourselves some grace when it comes to financial matters, and how to get started saving and...

Join the show.

Interested in being on the show? Tell me a little bit more about you and what you’d like to talk about!