Real Estate Syndication with Ruben Dominguez

Curios about real estate syndication, but don’t know how to get started? Ruben Dominguez shares his experience into the proper mindset and path to success!

Listen to us On

About the Episode

LifeBlood: We talked about real estate syndication, transitioning from single family to multi-family investing, the proper mindset for success, how to find the right mentors, and how to get started with Ruben Dominguez, Founder and Principal of Totem Capital Group.

Listen to learn why focusing on helping others can get you to where you want to go a lot faster!

You can learn more about Ruben at TotemCapitalGroup.com and LinkedIn.

Thanks, as always for listening! If you got some value and enjoyed the show, please leave us a review wherever you listen and subscribe as well.

You can learn more about us at LifeBlood.Live, Twitter, LinkedIn, Instagram, YouTube and Facebook or you’d like to be a guest on the show, contact us at [email protected].

George Grombacher

Lifeblood Host

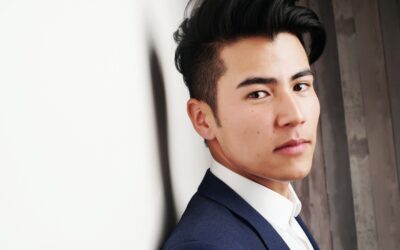

Ruben Dominguez

Guest

Episode Transcript

wouldn’t let this is George G. And the time is right. Welcome. Today’s guest is strong and powerful Ruben Dominguez Rubin. Are you ready to do this? I am. I am. Thanks for having me. I’m excited to have you on. RUBIN is the founder and principal of total capital group. They’re a Texas real estate investment company specializing in multifamily syndication. And he is the co founder of apartment educators. Reuben, tell us a little about your personal life smart about your work and why you do what you do.

Ruben Dominguez 0:40

You got it. Thanks, George. So I am married. I have three children ages 12 I’m sorry, ages 13, almost 1412 and nine, and I live in San Antonio, Texas. I’ve been here since about 2003. And it’s a little bit my personal life and for work, I am a real estate investor, we invest in multifamily, larger usually 100 unit plus here in south Texas. And we’ve been doing that sense about well, real estate investments since about 2008. And specifically in multifamily since about 2017.

george grombacher 0:00

Come on

Nice. So walk me through your journey in real estate, how you got started in 2008. And how you progress 200 units plus

Ruben Dominguez 1:32

you got it you got it. So it’s a pretty interesting story. I never really meant to get into real estate. My wife obviously she’s She’s the brains of the relationship. She she actually bought a book a long time ago called The Real Estate Investing for dummies. I don’t know if you remember those four Jami books or yellow books? Yeah. And I was totally against it. I said no way. I do not want to deal with tenants. You know, there’s all this stuff that they do they destroy your house, and I just didn’t want to do it. And so we never actually did anything with that. Until I was ready to move into a bigger house. You know, we had we had small kids. And we were we had this tiny little house and we were having another baby and I said this house is way too small. We’re gonna move I found another house and she was smart. She said, Nope, we’re not moving to the house, unless we can keep this house that we’re in rented out. So she kind of forced us into real estate investing. And I thought it was amazing that someone would were someone was paying us right, it would pay all of our bills on that property. And then we were leftover some cash flow. And so I tried to figure out that we do this over and over and over again. And I called the bank and it was the wrong bank. I realized that later. They weren’t a bank that would deal with investors. So they were just Consumer Bank, right. And so they told me, Oh, you can’t really do that. You can want one second home like a vacation home. And so I decided that’s probably not a good way for us to invest because it was really difficult for us to buy or they I thought it was really difficult for us to buy another house. And a couple years later, I saw a buddy of mine that he kept buying house after house after house. I saw this as rentals. On his on, I think it’s Facebook. And so I called him up had lunch with them, he told me about something called the burr strategy, which is it’s a single family investment strategy where you buy it, rehab it, refinance it, and then rent it out. And so once I found that little trick I I tried to do that over and over. And over time I was working out, I was an executive for an IT firm here in San Antonio. And I was trying to replace my income. And the reason I was trying to do that is because I wasn’t spending a whole lot of time at home I was I was not seeing my kids, they come home and my wife would tell me, Hey, our son did this or daughter did all these cool things that I was missing. And I said, Man, this is not I don’t get this time back. This is this is time, I’m never gonna have this opportunity to see my kids do this again. And so I was looking for a way to get out of work. And I was trying to do it with single family and I don’t know, we probably did 50 Single Family transactions over the course of about five years, and that’s rentals and flips. We only really did flips to find more rentals. And then we did some wholesale deals on trying to get the best deals for our rentals. And about I think it was 2014 I looked back and we had purchased six rentals that year and upon a denture done a bunch of flips and wholesale deals and I wasn’t that closer to just getting out of that w two job and so so there’s got to be a better ways I started researching around I was in I was in a real estate investing group and a lot of those guys were doing multifamily and so a bunch of them told me hey, you need to get into multifamily and to me me, it was a really big step from a single family house for $100,000 at the time, to these, you know, 5 million $10 million building. And so I finally decided in 2017, to start investing into that, and I started investing passively, I would just put my money into other projects, other people’s projects, they go out, do all the hard work, I had a full time job at that time. So it was difficult for me to do most of them, I just couldn’t go out there and raise money from people and not give it my full attention. So I started investing passively by me. At the end of 2017, early 2018, I did my first deal on my own, and with some partners, right, I never did it on my own fully. And that’s how that business works, you normally have a couple partners that help you get the project over the line. And that’s something you can’t really do in single family, I found out. And then that was it. Once I did that I was I found the magic. And it was wow, this business is amazing. You know, so we call it a win win win, our investors win. Because they are able to put their money to work for them, our tenants win because we’re going in there and we’re fixing up the place and we’re making it nicer. And we’re giving them a great place to live. And then we went right because we get to go out and do these projects. And so that was really the magic what we found them. And it’s been great ever since we’ve been doing a lot of projects here in Texas. And

we have been, we’ve been really excited. And we’re really excited about next year as well. So that’s a little bit about the journey.

george grombacher 6:36

Nice. Well, I appreciate all that. So certainly. Well, do you consider that to be invaluable experience, the experience of doing 50 single family homes or five years?

Ruben Dominguez 6:48

You know, I would say it was great experience. I mean, it did a lot for me. It was it was crazy. I mean, I thought I was busy before have you know with my my w two job. And I started doing that on the side. And it was all nice all weekend, every single break I have, buddy, it was great experience, I think really where it gave me good experience with contractors. And then also dealing with banks, although I know it’s crazy. But the the financing we do on these larger projects is easier than it was on the single family homes. But I wouldn’t feel like if anyone’s listening that wants to go into multifamily and not do the single family. It’s not required, you can do multifamily. You could do it either without having to go through all that single family. So it’s just make sure that that whoever’s looking to get into that, that there have a good mentor, right. That’s done some multifamily report. But there’s some similarities. But it’s not it’s not a requirement for sure.

george grombacher 7:47

Yeah, it seems to me that that if there was a way to, for lack of a better term, skip the line a little bit and just get right into the the better way that you described it, and really the Win Win win, then why wouldn’t people want to do that?

Ruben Dominguez 8:04

I agree. Yes. And I would, I would definitely say that, you know, for me, it was more of a mindset thing than anything. It wasn’t that I couldn’t do that those big projects. And I think it was for a lot of people, it just took me, you know, it was my brain couldn’t wrap around a $10 million building or a $20 million building. So there’s no way those are rich guys doing those deals. And really, it’s like, there’s no difference between a single family and multifamily. It’s just some zeros on the end. And so I think if anyone’s out there is thinking, oh, man, I want to do multifamily. But I don’t know if I can get into that those are huge deals that you can’t, you can absolutely do it without any experience in real estate. You just got to surround yourself with the right people that are doing those deals and make sure that you’re following in their footsteps and the things that they’ve already done successfully. So

george grombacher 8:53

and that makes sense. But that’s not I can’t imagine it’s like anything else. That’s not an easy thing to do necessarily, because they feel like there’s probably a good amount of people who hold themselves out to be able to help people with deals like that, but maybe they’re not.

Ruben Dominguez 9:07

Now and I think the way that I did it, you know, I was in a real estate group. And so I was surrounding myself with people that are in single family, but because there’s a lot of multifamily people in that group. I was also surrounded by them. So it kind of gave me a little bit of confidence to do that. And there’s a bunch of those groups out there. You know, there’s a lot of real estate investing groups of multifamily. There’s a lot of conferences. So somebody is really trying to dip their toe in AI to get out to some of that stuff in your local market or even some of these national conferences and start talking to the guy from these groups. And you’ll see like, hey, this guy’s just like me, or, you know, for me, it was like, well, that guy can do it. He can do it. I can do it. Right. He’s kind of like me. And so and so I think that really, that really helped me get over that hump because it’s really just a mental hump. But I mean, I know it’s easier said than done. You’re getting over that. And that’s that’s the toughest part to, to the business, I think.

george grombacher 10:06

Yeah, well, that certainly does make sense. But don’t believe that it’s available to me that I can do it that I’m probably not going to pursue it at all. So. Exactly, exactly. So how are people engaging with you now you are, you are the the person who is who is raising the money, and you are finding the deals and you are going and improving the properties.

Ruben Dominguez 10:30

Yep, all of the above. So we are, how we normally work is we’ll go out and we’ll look at a bunch of properties, you see, you know, between 30 and 50 a month. And the reason we do that is it’s a very competitive market. And most of the projects we look at aren’t going to work. And so because we’re looking for a specific type of project, right, we’re looking for something, we can go add value to something that’s a little bit older, right? 1980s 1990s, it’s probably not been upgraded in a long time there, there’s a lot of deferred maintenance on the properties. So just finding a property like that. And then normally, the seller is going to want too much for it. And so we can’t pay what they want. Because what we’re looking for is something where we can provide some great returns and some safety to our investors, we don’t want to buy a super expensive stuff. And so that’s tough. And so we’re looking for the properties, once we find one, we’ll put it under contract, but we’ll do our full due diligence on it, which is we walked every single unit, we look at all the major subgroups, plumbing, foundation, electrical, you name it. And then once we get past that, we will then release that to our investors, because we want to make sure before we tell our browser, Hey, we’re raising money that we we actually have the property and we know we’re going to close on it. So we don’t want to find something crazy, that comes up. And then we say, oh, sorry, nevermind, we can’t close on that, because of whatever it was we found. So we do that. And then we close it, and then we operate it, which I always like to say that, you know, closing is just the first step. And then the real work starts because we got to execute a business plan, which is normally interior rehabs will make them look nicer. And then we, you know, we’ll try to increase rent to market because normally those places that are in disarray aren’t renting for what that could be or should be. And sometimes you got some, some tenants that shouldn’t be in that neighborhood. But the ranch and it is it’s the cheapest place in the neighborhood. So we’ll make them nicer. And we’ll put them we’ll bring them to market rents. And we’ll get anyone out of there that shouldn’t be shouldn’t be there. And so that’s the real work, operating the property. And we do that will normally hold it for three to five years, and then we’ll sell it once we have executed that business plan. And it normally takes us, you know, two to three years to rehab the units that we want to rehab because we were doing two to four months normally. And so you know, if you got 200 units, and you’re rehabbing half of them, it’s gonna take you a couple years to get those done.

george grombacher 13:04

Got it? Let’s really make sense. So as you are, how are you finding these these targets? You talked about how you look at 30 to 50 deals a month that people bring them to you do you have a program that sort of scours all the units that are in your region.

Ruben Dominguez 13:23

We get about 90% of our properties from brokers. So the big brokers, and there’s bunch CBRE north, Mark, Marcus and Millichap. There’s some big brokerages out there. Normal normally, they’re all going to be sold through anything over about 100 units just depends on your market, it’s going to be sold through the brokerages because they’re guys like us, or they might be they might be REITs or some type of institutional owner. And so they’re all going to take their properties to brokers, you might find one or two mom and pops that have worked their way up through multifamily, and they might own something large. And they might be willing to entertain a direct buyer, I’m sorry, direct to seller offer. But normally those those are on the smaller multifamily properties in the product 70 and 75. And under, at least in this in this market that we’re in. So we’re finding them through brokers. Now it still doesn’t mean I just see a lot of brokers put properties out and they’ll be deals that don’t work, right. So I’d say probably the last three out of four projects we did and the broker brought them directly to us and said, Hey, this seller either needs to sell fast or like one project we closed on back in September. They said hey, I know you bid on this project three months ago and we declined the offer but if you can still do that offer we’re willing to sell to you. And I think in multifamily the name of the game is are you able to close the project first consider a lot of people that will get to contract, where they’ll send out an offer, and they can’t actually close it, because they’re hard to close, right? These are big projects that require a lot of money. And the loans are kind of tough, right? If you’ve not done it before, they’re hard to get. So brokers are bringing into us because we have a great reputation in the market, they know that we’re going to close at the price that we offer at what’s called retraining, right, we never want to get into contract for something, and then less, we’re finding something major, and our due diligence, we’re not going to go back and say, Hey, we need a discount for this, right? It’s got to be major, it’s got to be $100,000 $200,000. Something wrong. And so that gives us a great reputation. And we’ve found that brokers in this market are now bringing us projects, because they know we’re going to close and they know that we’re going to not come back and ask for a discount. So that’s how we’re getting most projects.

george grombacher 15:52

Yeah, that’s just makes sense. Because they are motivated, obviously to, to do a good job for their client and to sell and, and make sure that the deal goes through. So it all makes sense. Ruben, I like it. Well, the people, the people are ready for your difference making tip, what do you have for them?

Ruben Dominguez 16:12

I always like to say, you know, in this has been the my success. My whole career, even in my corporate career, you know, I was an executive, I worked my way from just, you know, regular salesperson. And then I managed to support I was in the operation side all the way into executive leadership. And that helped me there. And I learned a lot about that there. And then through my, my best injuring as well. So my tip is if you find a way to help others, right, and the way that we do that with multipin is, you know, we’re, we’re working really hard to make sure our investors are successful with with their investment into our projects, right. So if you’d look for another way to make somebody else successful, or help them, you’ll normally also benefit from that. And so with multifamily, right, we’re out there working really hard for our investors, in trying to get the best return the highest return, we can buy the best properties we can for them. And because we’re doing that we’re also succeeding. And so that’s really my tip is when you’re looking at something, whatever it is you want to do, even if it’s at work right at work, it was, for me, it was I’m trying to do the best job for my teams, in for our customers. And if you look at whatever you’re doing that way, there’s almost no way you can fail, right? Because you’re providing something for somebody else. And and people recognize that and so that’s going to make you successful in whatever you do.

george grombacher 17:40

I think that that is great stuff that definitely gets come up. Ruben, thank you so much for coming on. Where can people learn more about you and totem Capital Group? And how can people invest or get involved?

Ruben Dominguez 17:52

Yeah, so you can visit our website, it’s totem capital. group.com It’s like a totem pole, if anyone’s interested and then also you can email me it’s Reuben are up n at totum capital group.com.

george grombacher 18:06

Perfect. Well, if you enjoyed this as much as I did show ruin your appreciation and share today’s show with a friend who also appreciates good ideas go to total capital group. com that’s t o t m, capital group.com. And shoot Ruben an email Reuben at total capital group.com and find out if there’s a good fit. Thanks. Good, Reuben.

Ruben Dominguez 18:28

Thanks, George. It was a pleasure. I appreciate it. For sure.

george grombacher 18:32

And until next time, keep fighting the good fight. We’re all in this together.

Transcribed by https://otter.ai

More Episodes

Buying Your Next Home: A Step-by-Step Process

You’re thinking about buying a home, that’s very exciting! Home ownership has always been an integral part of the American Dream, and home values account for a large portion of many Americans overall net worth. With that in mind, it makes sense you want to...

Personal Core Values: How to Create Your Code

Superman, Wonder Woman, Mother Teresa and Gandhi lived their personal values and followed a code. Superman holds strong to not killing, keeping his secret identity a secret, and using his powers responsibly. Wonder Woman lives to serve as a living example of the...

What Does It Mean to Wholesale Real Estate, How Do I Do It and Does It Make Sense for Me?

There are a lot of ways to become financially successful and there are a lot of people who have done so through the wholesale of real estate. Before we go any further, if you’re looking for a way to channel your inner Chip and Joanna Gaines from Fixer Upper,...

Understanding Presenteeism in the Workplace and What to Do About it

We celebrate when our sports heroes play hurt and we dislike it when they sit out. In the 2021 Summer Olympics, American gymnast Simone Biles opted out of competing because of her mental health and she was viciously criticized. We revere stories about...

How to Start a 401(k)

Daniel Kahneman, a Psychologist, won the Nobel Prize in Economics. He became fascinated by why people make personal finance and investing decisions, and it motivated him to focus his research on it. After releasing his results, he made this damning assessment of the...

Debt Free: What to Do if You’re Over Budget and Feeling Stuck

You want to be debt free. You created a budget. You’re trying to be smart with your money. But there’s never enough money to go around and you’re feeling stuck. Lots of people have been there and lots are still there. I’ve been...

Financial Wellness: Developing a Sustainable Program

It’s gotta fit. Even if the new thing you’re starting is the most beneficial thing in the world, if it doesn’t fit into your life or organization, it won’t last. It won’t be sustainable. A financial wellness program could be just what your company and your...

Steps to Success: What it Means to Level Up

What if there were steps to success you could follow that would take you to the level above the one you’re at? What if you could then lock in your gains and make that level your new normal? Would you take those steps? There’s a lot of talk these days...

Morning Routine Checklist

The value in having a morning routine checklist If I had a lifetime checklist, living intentionally would be at the top. Having checklists for things is a means of doing that. I like to get up early because there’s not a lot of other people that do. It...

Join the show.

Interested in being on the show? Tell me a little bit more about you and what you’d like to talk about!