We all have limiting beliefs.

The child of billionaires could think, “There’s no way I’ll ever be more financially successful than my parents.” The child of degenerates could think, “There’s no way I’ll ever amount to anything.”

The important question for you to ask yourself is, “What are my limiting beliefs?”

I certainly had a lot, and everyday, I’m on the lookout for more. Early in my career, I thought, “No one will take me seriously. I need to partner with someone who’s older.” In reality, most of our limiting beliefs are nonsense that found its way into our heads when we were kids. The problem is, if we fail to address them, they’ll cap our potential.

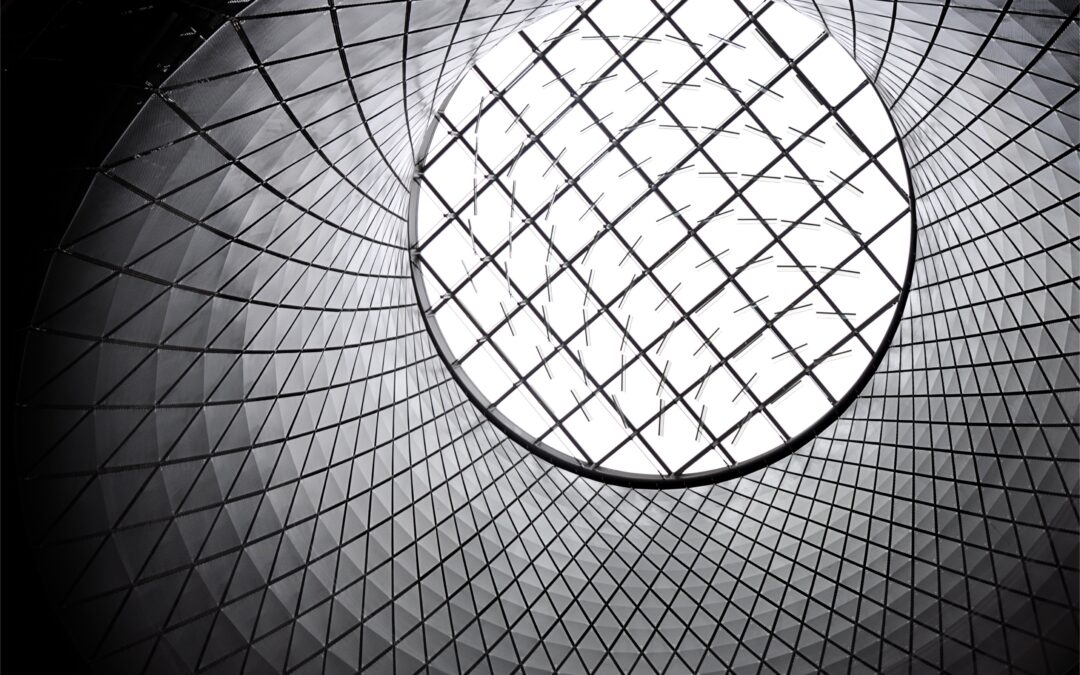

There are glass ceilings imposed on us culturally. A clear example was the inaccurate belief that women could not be CEOs of major companies. That was a commonly held belief until it wasn’t anymore. Once someone defies the norms, small cracks begin to appear. When enough people do the unbelievable, the glass ceiling shatters.

Limiting beliefs are our personal glass ceilings.

If you believe you’ll never earn six figures, you’ll never earn six figures. If you believe you’ll always struggle with money, you’ll always struggle with money.

When the opposite is true, your proverbial elevator can speed all the way to the top floor with no stops. With the proper beliefs, your potential is unlimited.

Your money beliefs = Your ultimate financial potential

For the past 20 + years, I’ve been helping people replace limiting beliefs with beneficial ones. I’m honored to be named to Investopedia’s list of the top 100 financial advisors many years running. My goal is to do the same for you.

Here’s what we’ll cover:

- Where beliefs and values come from

- The danger of limiting beliefs

- The benefits of positive beliefs

- The danger of a lack of clarity on values

- The benefits of well-defined values

- Aligning your behavior with your goals

- Living your beliefs and values with your money

Let’s get started.

Where beliefs and values come from

For better or worse, the majority of our beliefs were formed when we were kids; from birth to 7 years old. The experiences we had, and everything we observed went into creating them. Just as our computers and smartphones have an operating system, so do we. Our beliefs become an integral part of that system.

So, if you had a perfect childhood, you’ve got mostly positive and beneficial beliefs. For most of us, we’ve got plenty of good ones, and some bad ones.

Similarly, we pick up our values as we move along through life. Our families, friend groups, communities, and experiences inform our values. Values are what we use to determine what is of the greatest worth.

We are the combination of our beliefs and our values.

Beliefs + Values = Who you are

In service of helping you dig into your beliefs and values, you can access our Values course for free.

The danger of limiting beliefs

Limiting beliefs = Your personal glass ceiling

Limiting beliefs will prevent you from achieving your ultimate financial potential. They can limit your success as an investor, and limit your career and earnings potential. They’re particularly insidious when we’re unaware of them (which most of us are).

While beliefs are often given to us through our childhood experiences, holding onto bad ones is nobody’s fault but our own. Once we’re aware of their detrimental impact, it’s incumbent on us to do something about it. But how do you know what yours are? Look for negativity and doubt.

When you notice yourself thinking things like;

- I could never afford that

- I’ll never make that much money

- That investment is too complicated for me

- I’m never getting that promotion

There’s a good chance you have limiting beliefs. It’s also wise to look for areas where you feel the most internal resistance. If you have a hard time budgeting and reviewing your spending, you may have limiting beliefs about money.

Being mindful simply means paying attention to what you’re thinking and feeling. The more aware you can become about your thinking and feeling, the better you’ll become at recognizing your limiting beliefs.

The benefits of positive beliefs

Positive beliefs = Shattering your personal glass ceiling

The skies are the limit. When you’ve got positive financial beliefs, you shatter your personal glass ceiling

How do you do it? Think about how you’d like to think and feel about money. When you catch yourself having negative thoughts and feelings, replace them with the ones you want to have.

And I want you to literally do it. When you catch yourself thinking, “I’ll never get that promotion,” tell yourself “I’m doing everything within my control to earn the promotion I want.” Then start doing everything you need to in order to position yourself for success.

You, and you alone, get to choose how you think and feel about everything in your life. Put that power to work.

The danger of a lack of clarity on values

Values and beliefs = Who you are

Values are the other half of who you are. They are the lens through which we see the world. They inform how you allocate your resources, and in this context, your money. What you spend your money on, how and what you invest in, and your long-term financial success will greatly be influenced by your values.

Everytime we decide to do one thing, we’re deciding against doing something else. Money has time value, meaning the longer we wait to pursue our financial priorities, the harder they are to reach. When we’re unclear on what we value financially, we’re at risk of making sub-optimal decisions that can take us further away from our priorities.

How do you know if your financial values are serving you? Play it out. If you keep doing what you’re doing (or not doing) with your money, where are you guaranteed to end up?

If that destination isn’t what you want, it’s time to get clarity on what’s most important to you.

The benefits of well-defined values

When you have well-defined financial values, you can align them with your financial behaviors. The more aligned your spending, saving, and investing can be with your values, the better off you’ll be. You’ll make better decisions which will position you for long-term financial success.

How do you get well-defined values? In service of helping you do that, you can access our Values course for free.

Aligning your behavior with your goals

Your behavior = The importance of your goals

Your behaviors are the ultimate expression of your values, and are evidence of how important your goals truly are.

If one of your goals is to be debt free, but you don’t have a plan for paying off debt and you’re increasing your credit card balance every month, you’re not serious about becoming debt free. When we say one thing, but do another, we’re out of alignment.

The idea is to create a compelling vision for our future (goals), and to put our beneficial beliefs and values to work in service of realizing it.

Will your current financial behaviors get you where you want to go? If not, stop BSing yourself and make the necessary changes.

Living your beliefs and values with your money

A wake is what’s left behind. Boats leave a wake in the water. People leave emotional wakes behind them. The choices we make with our money also leaves a wake.

Think about it like this: You’re going out for dinner tonight and you’ve narrowed your choices down to a local mom and pop, or a large national chain. Should you opt for the chain, and do so repeatedly, your financial wake could eventually put the mom and pop out of business.

Every time we allocate our money, we’re casting a vote for one thing over another. There’s a big opportunity to be more thoughtful with our money, and to align our use of it with what’s most important to us.

Local businesses are the Lifeblood of vibrant communities. Through our spending behaviors, each of us can have a positive impact on them. It’s a privilege to be able to think about and make the decision to shop local whenever possible, and one I proudly make as often as I can.

My goal here is to share some thoughts and ideas on how you can be more thoughtful with your money. The reality is, you’re having a meaningful impact- let’s make sure it’s the impact you want to have.

Your current defaults

Anytime you’re thinking about making a change, you need to start with knowing where you’re currently at. We all have patterns and habits we follow. You’ve probably got favorites in almost every aspect of life. Maybe you’re in the habit of stopping for a coffee in the morning, or going to the same pizzeria every Saturday. Whatever aspect of life we’re talking about, you have preferences.

Some preferences we’re keenly aware of. Others, we’re simply on auto-pilot.

To know how you’re allocating your dollars, you’ll need to audit your cash flow. Open every account you use to spend and invest money, and track each transaction. This will tell you where and to whom your money is going.

But what’s possible?

What’s possible

What’s possible? What impact can you really have? In many ways, this is one the most important questions you can ask yourself.

When we watch the news, or go online, we’re inundated with the world’s problems. We see minor injustices and existential problems alike. It’s never ending. A compassionate person looks at a problem and wonders how they can help to solve it. But for many big problems, our contribution feels insignificant.

But here’s the thing, all we can do is exercise control over what we can control.

Recycling your dollars

When you allocate your dollars in places aligned with your values, you’re recycling instead of spending. This is a powerful way for you to make an impact. As Gandhi said, “Be the change you want to see in the world.” This is a simple way for you to make that happen.

I’m going to highlight three common areas you can make changes.

Lifestyle

To be more thoughtful with your lifestyle spending, think about spending locally instead of nationally. If you’re living in a city, you’ve got a ton of choices for eating out, entertainment, and personal care. Is it possible for you to do business with local businesses?

Doing so can be better for the environment by lowering the carbon footprint. You’ll be investing in your community. There’s also a greater potential for sustainably sourced local materials. And at the end of the day, if you want local businesses to stay open, you’ll need to invest in them.

Banking

To be more thoughtful with your savings, become a customer of a local bank. There are a lot of benefits to banking locally. According to research, you’ll pay lower fees, get more personalized attention, enjoy higher quality service and higher ethical standards. Changing banks is a short-term hassle, but it will pay long-term dividends.

Investing

While imperfect, ESG investing is a step in the right direction if being more thoughtful with your money is desirable. Companies like Morningstar have developed screeners that can help you select for certain priorities within a mutual fund, ETF or stock.

Worried about toxins and pollution? Stop investing in companies harming the environment. Wish you could help improve education? Start investing in like-minded companies. Similar to changing banks, this will take some up-front work, but will have a lasting impact.

Your desired impact

The more clarity we can get around what’s important to us, the better. I don’t think there’s ever been a more important time to think about what you stand for, and what you stand against. This is also a time that demands critical thinking and independent thought.

Values become the lenses through which we see the world. They help inform how we allocate our most valuable resources of time, attention, and money. A conversation about being thoughtful with money demands thinking about values.

I was raised with traditional values, as I am sure you were as well. But when was the last time you thought about your personal values? For me, it took until my mid 30s.

Making incremental changes

Like any meaningful change, it will take time. The trick is to shift your habits and patterns. If it’s your goal to lose weight, you make changes to your nutrition and fitness. This requires overall lifestyle changes.

Becoming more thoughtful with money is the same. You figure out what changes you want to make, look at where you’re at, and put plans in place for making it happen.

Closing

Limiting beliefs are our personal glass ceilings. When we’re unaware of them, we’re subject to frustration, stress and anxiety. Once we can see it, we’ve got the opportunity to smash through it.

There’s so much value in examining our thoughts and feelings. Doing so can lead us to breakthroughs which can result in greater success with our money.

If you’re ready to take control of your financial life, check out our DIY Financial Plan course.

We’ve got three free courses as well: Our Goals Course, Values Course, and our Get Out of Debt course.

Connect with one of our Certified Partners to get any question answered.

Stay up to date by getting our monthly updates.

Check out the LifeBlood podcast.

LifeBlood is supported by our audience. If you purchase through links on our site, we may earn an affiliate commission. Learn more.