Trust and Will with Cody Barbo

Has estate planning been on your mind, but you just haven’t gotten around to getting it done? Cody Barbo can relate and talks about the low-cost and easy to use option he’s created in order to help you finally get yours done!

Listen to us On

About the Episode

LifeBlood: We talked about trust and will, the estate planning process, what it takes to be a successful entrepreneur, and how to keep everything in balance.

We discussed the personal experiences that motivated Cody to found Trust and Will, how many of his closest friends we’re having the same problems, and the progress they’ve made in addressing the estate planning needs of people.

We talked about how the pandemic brought the reality of death to the front of many people’s minds, how procrastination keeps people from doing many of the important things they need to be doing, and what can be done to bridge the gap between knowing how to do something and actually getting it done.

We discussed the importance of building trust, making things as easy as possible, and meeting people wherever they are.

We talked about the demographics of people using the service, the partnerships they’ve formed to increase distribution and what the future holds with Cody Barbo, Founder and CEO of Trust and Will, an organization disrupting the trust and estate planning industry with an easy, fast and secure way to set up your estate plan online.

Listen to learn the role a good night’s sleep plays in your success in every aspect of life!

For the Difference Making Tip, scan ahead to 17:51!

You can learn more about Cody at TrustAndWill.com, Twitter, Instagram, Facebook and LinkedIn.

Thanks, as always for listening! If you got some value and enjoyed the show, please leave us a review wherever you listen and subscribe as well.

You can learn more about us at MoneyAlignmentAcademy.com, Twitter, LinkedIn, Instagram, Pinterest, YouTube and Facebook or you’d like to be a guest on the show, contact George at [email protected].

George Grombacher

Lifeblood Host

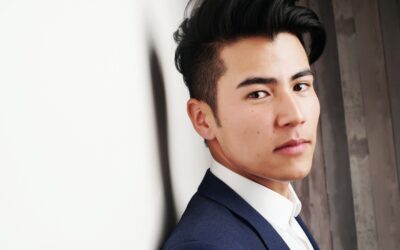

Cody Barbo

Guest

More Episodes

Financial Wellness in the Workplace: 401(k) Plans

This is so important; if we don’t save money for our retirement, no one will bail us out. This is so powerful; we get so many of our most important benefits through our employers. This is so time sensitive; we need to get started saving and investing for our...

How to Take Personal Responsibility for Your Money and Get Your Finances in Order

People have all kinds of financial goals. Some want a Ferrari and a mansion, some want to take nice vacations every year, and others want to get out of debt so they can stop stressing about money. Whatever your goals, I want to help you take personal responsibility...

Effective Persuasion: Am I Referable?

Referrals are the best. They’re the best way to meet new people. Look at this list and decide if you’d rather be introduced to the person through someone you like and trust, or to pull them out of the yellow pages or Google search:...

Want a Life of Significance? Embrace the Gift of Fear

Living a life of significance has certain requirements. It requires you to step out of our comfort zone. To embrace change and adversity. To become a person of action and a wise decision maker. And all of those things require you to embrace the gift of...

Who Am I? How to Write Your Next Chapter

I’m not intending this to be an existential conversation where you question your place in the universe. What I’d like it to be is the catalyst for you to start doing that thing you’ve been wanting to start doing. To help you lean into the question of “Who am I?”...

Financial Wellness at Work: The Underlying Strategy

Getting people to take beneficial action is puzzling and difficult. It’s clear cigarettes are bad for us, yet many still smoke. Most people understand it’s valuable to spend less than you make, yet a majority live paycheck-to-paycheck. To help...

Want a Life of Significance? Make Yourself Strong

Just getting by can be difficult. Becoming a success is challenging and admirable. Living a life of significance requires extreme focus, inquiry and consistent work. It’s available to all of us, but something too few aspire to. What would the world be like if...

Succeeding in Life: Stop Wasting Time

We all have enough time to do just about anything we want. We can start businesses, open a restaurant, become painters, or learn how to play pickleball. But we don’t have time to waste. If you’re interested in succeeding in life, you’ve got to stop wasting time. ...

7 Prioritization Tips for Better Time Management

A big part of prioritization is proactively making decisions about what’s important and should be paid attention to, as well as what is unimportant and should be avoided. It’s knowing the highest and best use of your time, and working to spend as much time as...

Join the show.

Interested in being on the show? Tell me a little bit more about you and what you’d like to talk about!