Stop Trading Stocks

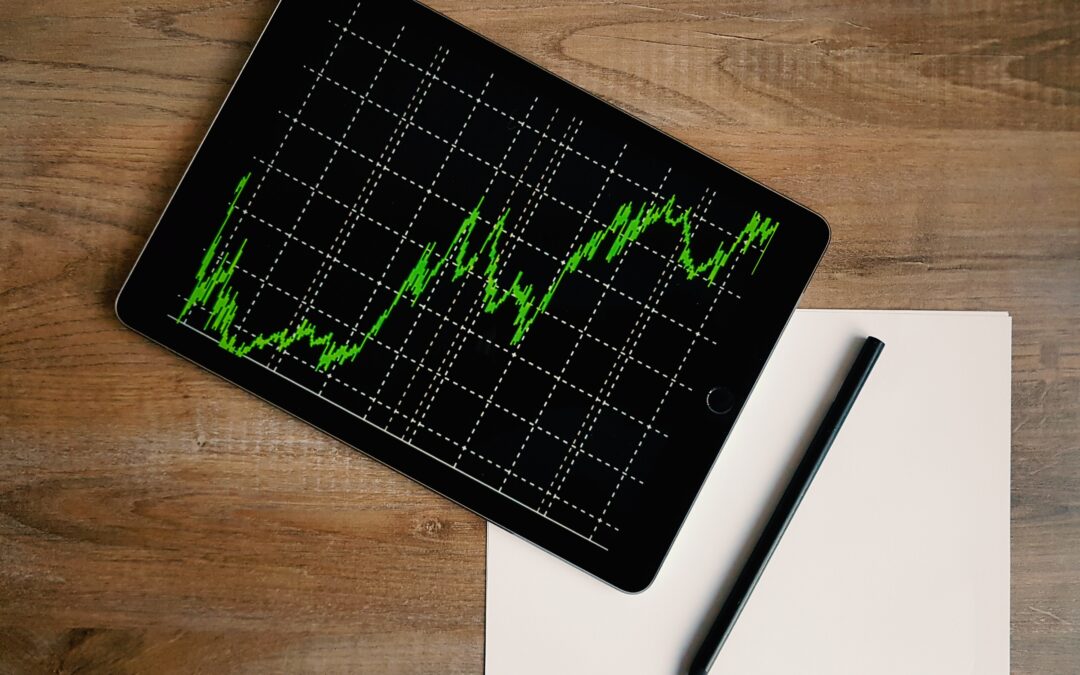

Should you start or stop trading stocks? Is it possible to get rich doing it?

George talks about the realities of wealth building and when it’s time to invest in passive versus active investments.

Listen to us On

About the Episode

Should you start or stop trading stocks? Is it possible to get rich doing it?

George talks about the realities of wealth building and when it’s time to invest in passive versus active investments.

Get your copy of George’s newest book, How to Get Good at Money: The Keys to Financial Peace of Mind and Prosperity

Get your copy of George’s first book, Be Your Own CFO: A Businesslike Approach to Your Personal Finances

Find the free Goals, Values, and Get Out of Debt courses at

https://moneyalignmentacademy.com/ondemand-courses/

Ready to get your finances together? Check out our DIY Financial Plan Course:

https://george-grombacher.aweb.page/DIY

Get our monthly updates here:

https://george-grombacher.aweb.page/

Thanks, as always for listening! If you got some value and enjoyed the show, please leave us a review here:

https://ratethispodcast.com/lifebloodpodcast

You can learn more about us at LifeBlood.Live, Twitter, LinkedIn, Instagram, YouTube and Facebook or you’d like to be a guest on the show, contact us at [email protected].

Stay up to date by getting our monthly updates.

Want to say “Thanks!” You can buy us a cup of coffee

George Grombacher

Episode Transcript

Is it possible to get rich trading stocks trading crypto? Yes, clearly it is. People do it all the time. Just went through this really unique period of time where people got crazy, crazy wealthy, investing in Bitcoin and other crypto assets, cryptocurrencies, tokens, whatever it might be NF T’s, so many amazing new things. And then a lot of people lost everything that they had made, rode the wave up, that many people unfortunately rode the wave down, some people lost everything. During that wave, they didn’t have much before, they made the right investment on the time when it was going up. But then unfortunately, made wrong decisions on the time when it was going down when it was losing value. And that’s one of the big challenges when it comes to making money with an individual security or an individual thing. I don’t know if crypto is a security or not, we’re kind of going through that right now. You need to be right when you buy it. So you need to make sure that you’re getting in and buying at the right price hopefully low. And then we want it to go up. And then we want to be able to sell when things are high. But that just goes against all aspects of human nature. We want to do the opposite, right? I want to buy when things are really high, because I don’t want to miss out. It’s like, oh my gosh, look at all these people making all this money. Is it too late now? I’m getting in high. And then we want it to is we want to sell when things are low. That’s it, oh my gosh, I gotta get out of this. This is terrible. Losing my money, losing my mind all these things. So again, it’s the opposite of what we know intellectually we should be doing with our money we should be buy when things are low, and selling when things are high. When bitcoins at $70,000 a Bitcoin, that’s all we want to talk about. When it’s at $15,000, a Bitcoin, nobody’s as interested in talking about it. So it’s an interesting thing. So are there people out there making tons of money investing in individual investments? Yes. So is it possible to do that? Yes, it is. Is it possible to beat the stock market? Of course, it is. Just like, it’s possible for people to play in the NFL, it’s possible to do it. People are doing it. Can you play in the NFL? Maybe? Can you beat the stock market? Maybe there’s a lot of preconditions that must go into it, though. how interested are you? And learning about the stock market? Or about the cryptocurrencies? How willing are you to invest the time, the attention, the energy that it’s going to take to gain that knowledge, and then to make sure that you are tracking and paying attention to everything? Because if it were just as easy if it was easy, as you know, you just buy it, and then you hold on to it, and you’re wildly rich? Well, then everybody would do it. But that’s not how that goes. There was a pretty exhaustive study, I think it was in the 90s that just track people in who were investing in brokerage accounts. And it was, who’s doing better, or people that are taking a more passive approach. So buying things like mutual funds, and just holding them? How are they performing versus people who are in their account, making trades, trading stocks, and bonds and everything else? Turns out that the people who were making the active decisions and buying and selling performed 6% Worse than people who just bought boring things, and continued buying boring things. So there’s evidence right there, that for the vast majority of people, it makes more sense. Just to take a more diversified, boring, blah, approach to investing. Does that do anything for you? Have I talked you into anything by sharing statistics? Probably not. That’s okay. I want you to get what you want when it comes to money. So if you want to get rich, well, that’s what I’m interested in helping you to do. If you just want to have peace of mind and to be able to credit card debt and to stop worrying about money. Well, that’s what I want for you too. Doesn’t matter to me. What it is that you want. I’m interested in here in the real world, helping you to get closer bring those two realities together, your current reality and then your desired reality. I want you to have that. Here’s one thing that I know. I know that you need to have financial security before you can pursue financial prosperity. I like I don’t necessarily like hacks. On the side, I don’t like life hacks. I don’t like shortcuts. Because I found that they really don’t work. Now, again, works for some people, awesome. Will it work for you? I don’t know. What I’m interested in helping you to do is to position yourself for long term success. I’m not trying to get you to not be rich, what I quite the opposite. I want you to position yourself and be on track for becoming rich. And just in case, the stock you pick doesn’t hit, or the crypto that you pick doesn’t hit, or you don’t get out the right time you buy at the wrong time you sell at the wrong time, or regulation happens, or some who knows. So many variables out there that are not beyond that are beyond our control. Just in case everything doesn’t go perfectly to plan, that you’re still in a good position. That’s prudent, I think. So hopefully, you are somebody who appreciates that you want to be in a position to be successful. So in order to be financially independent, in this day and age, you’re going to need a lot of money, you’re going to need I think to amass at least a million dollars, and some kind of assets. And it could be stock market investments. It could be real estate assets. It could be cryptocurrency, that doesn’t necessarily matter to me, I’m not I’m agnostic, for the most part on what the vehicle is that you’re interested in investing in. Just know that it’s going to take time. And the

the promise of making great big returns quickly is a strong one. There’s a strong pull there. You want to have nice things, you want to have a great lifestyle, I get it. So do I want all the nice things, I’d rather have a lot of money now. Versus Slow and steady wins the race. But again, I want you to be positioning yourself for success. And to be able to write yourself a permission slip, in order to start taking those big swings, start taking bigger risks towards large, big kind of kind of big returns. So how do we do that? How do we build our foundation? How do we how do we find financial security first, and it’s not the most exciting thing in the world. But I really advocate that you need to have six months worth of your monthly expenses saved up just in cash, super boring. But these days, you can get a better rate of return on cash than we were in the past. So that’s, I guess, sort of a good thing. You need to get to six months worth of cash saved up to cash on hand, it’s an emergency fund, that will really position you for success. If you are in credit card debt, need to get out of credit card debt needs to be a top priority for you to be able to do that. Then once you’ve done that, I want you to really focus on what your core financial plans are. So you need to have monies for your short term financial plans, which your your cash on hand and your six month emergency fund is a big part of that. It’s kind of like the cornerstone of it. But you also want to have money every year to be able to take vacations and travel and stuff like that. And that’s those are the plans that you need to be making. And then from a midterm perspective, just think three to 10 years, maybe you want to buy a house, maybe you want to save money for kids education. Who knows what that is. So those are plans I want you to make. And then finally the bigger one biggest one typically speaking, is being able to save for your eventual retirement, whatever that looks like for you. So think about your, whatever those plans are, and how much money it will take to get there. And what I want you to do is to take a boring approach, boring approach to accomplishing those goals. So just to use easy numbers, if you decided that you wanted to have a million dollars saved for retirement and you’re 30 years old. Just say you want to retire at 65 years old, you have 35 years to be saving money to save that $1 million at 65. And through wonderful financial calculators that you’ll be able to find where you have your money if it’s an IRA, an individual retirement account with fidelity. They’ve got great calculators there. If you’ve got a 401k with Principal Financial at your work. Each one of those companies will be able to tell you based on your age, your time horizon so age 65 to 35 years and it’ll help you figure out the kind of investor you are. Maybe you are a moderately aggressive investor because 30 figure you’ve got 35 years to invest. I think that that would be correct. How much will it take? How much do you need to be saving each month in that boring approach, boring, well diversified mutual fund or exchange traded fund, to be able to accumulate that $1 million and start doing that. So once you are funding, your, your goals, whatever short term goals, you’re funding those, so you are putting the money necessary today to achieve that goal in the future. So for your short term, mid term and your long term, well, now you’ve given yourself permission, you’ve written yourself your permission slip, to let it rip, go invest in individual stocks, go invest in, go invest in crypto. And, again, if you’re interested in doing real estate, that you can create a plan that will that will get you to where you want to go or get you to the amount of money that you’re interested in getting to. So it’s not necessarily just stock market investing. That was just a it’s an easier example for me to put together. So super cognizant, and I really want to pay attention to the fees and the expenses associated with any and all investments that I’m taking part in. So these days, you can get mutual funds or exchange traded funds ETFs for next to nothing, you can buy the s&p 500 mutual fund or ETF for literally, point one 5%. So that is if you had 100 pennies in your hand 100 pennies, that’s one percentage. So that’s 1%. A percentage point is made up of 100 basis points. So $1 equals 100. Pennies 1% equals 100 basis points. So if your s&p 500 mutual fund costs, point, one five, it costs a penny and a half. That’s it, that’s essentially free. So your fees and your expenses are super low. With investing, you can open up accounts that will not even probably charge you they’ll charge you very, very minimal annual fees, like 3035 bucks, probably a lot of them are free these days. So there’s not going to be a lot of drag from an investment standpoint, or costs, fees and expenses that are holding or keeping your returns down. What I talked about earlier, the biggest thing that’s going to keep our returns down is making bad decisions. It’s losing money. When you set yourself back and you lose money, it’s so hard to recover from that. And the thing about money is, it’s time sensitive. So the longer that we wait to be investing in pursuing our financial goals, the harder they become to reach, you know that you intellectually understand that. So just to sort of do a quick recap, it’s possible to beat the stock market, it’s possible to make a ton of money in crypto, you can become a real estate, millionaire or billionaire, all these things are possible. But let’s put some contingency plans in there as well. So while you are researching and learning and getting to know, whatever kind of investments that you’re interested in making, make sure you’re just taking the boring approach, slow and steady wins the race. And just be investing in passive type investments, low cost indexes, and just be putting money in. And along the way, you’ll learn so many wonderful things. You’ll fall in love with the doing, you’ll be debt free, you won’t be looking for shortcuts or hacks just be starting to come in at you’ll be approaching your investing from a position of strength as opposed to fear and scarcity. You’ll be developing great self discipline and wonderful habits. And then you’ll wake up 510 years from now and be like, Oh my gosh, I’m so glad that I took this approach. Because now I’m really good position to actually achieve all the financial goals and objectives that I’m interested in doing. And then along the way, take your big swings also, go get rich, that’s what I want for you want whatever you want. That’s what I want for you. Do your part, doing your best

Transcribed by https://otter.ai

More Episodes

Real Estate Syndication with Spencer Hilligoss

Real Estate Syndication with Spencer Hilligoss Interested in investing in real estate, but want something more passive than rentals or fix and flips? Spencer Hilligoss talks about the opportunities with real estate syndication, how it works and the benefits of...

Work-Life Balance with Vito Grammatico

Work-Life Balance with Vito Grammatico As a high performer, have you ever thought about why you feel burned out from time to time and what can be done about it? Vito Grammatico shares his expertise into why it happens, and some simple tools to start alleviating those...

Teaching Kids About Money with Dean Brauer

Teaching Kids About Money with Dean Brauer You've been giving your kids a cash allowance, but now it's time to transition to digital but haven't figured out how to do it? Dean Brauer talks about a platform he's developed to make that happen plus teach kids important...

Life Insurance Settlements with Jamie Mendelsohn

Life Insurance Settlements with Jamie Mendelsohn Got an old life insurance policy you're thinking of getting rid of because it's no longer necessary? Jamie Mendelsohn talks about how it could be more valuable than you think and shares her expertise into how to...

Startup Stages with Alon Braun

Startup Stages with Alon Braun Have an idea but struggling to bring together all the resources to make it a reality? Alon Braun shares his entrepreneurial framework for making it happen!About the EpisodeLifeBlood ENGAGE: We talked about the startup stages business go...

Health for Life with Meghann Hempel

Health for Life with Meghann Hempel Being overweight is a struggle that many of us fight our entire lives. Meghann Hempel has fought through a ton of adversity, she shares her story of resilience as well as an actionable process that you can take and apply in your...

Making Better Meat with Paul Shapiro

Making Better Meat with Paul Shapiro The methods through which we're currently producing meat are harmful and not sustainable. Paul Shapiro has devoted his life to developing new and innovative ways to address the problem, and produce a new and better meat!About the...

Improve Your Love Life with Erwan and Alicia Davon

Improve Your Love Life with Erwan and Alicia Davon We talked about how everyone is drawn to fun and how it’s imperative to incorporate that into our lives. How the pandemic has changed relationships for better and for worse. The advantages of working on yourself as...

Get Better at Sales with Ambrose Blowfield

Get Better at Sales with Ambrose Blowfield When thinking about sales, do you have a scarcity or abundance mindset? Ambrose Blowfield talks about the reasons behind why we feel that way and how best to overcome it in order to better serve our customers!About the...

Join the show.

Interested in being on the show? Tell me a little bit more about you and what you’d like to talk about!